Company Registration in Uganda refers to establishing a legal entity to conduct business activities within the country. This process provides legal recognition and protection and grants access to various business opportunities essential for success.

Are you thinking of starting a business in Uganda? This short video walks you through the investment opportunities, company types, and steps of registration of a company in Uganda, ensuring you have all the information needed to establish your business successfully.

Uganda Registration Services Bureau (URSB) Name Search

The Uganda Registration Services Bureau (URSB) is a government agency that registers businesses, companies, and intellectual property in Uganda. It offers a name search service to help individuals or companies check if their proposed name is available before registration. This ensures the chosen name is unique and not already in use.

How to Conduct a Name Search With URSB

Step 1: Choose a Search Method:

- In-Person: Visit any URSB office to request a name search.

- Online: Use the URSB online name search tool to check for name availability.

Step 2: Pay the Required Fee: There is a small fee for the name search. Check the current rates before proceeding.

Step 3: Submit Your Request: Register your business or company name once you confirm name availability.

The Registrar of Companies in Uganda oversees business registration, regulation, and monitoring. This office operates under URSB to ensure compliance with business registration and intellectual property laws.

Uganda Registered Companies

When establishing a business in Uganda, understanding the different types of registered companies is essential. Each company type has unique legal structures, requirements, and benefits that suit various business goals. Here are the most common types of Companies in Uganda:

- Sole proprietorship: A sole proprietorship is Uganda’s most straightforward form of business. It is an individual who runs a business alone without a formal legal structure. This means the owner is personally liable for the entire company, including debts and liabilities.

- Partnership: A partnership is a business structure where two or more people share ownership. It can be a general partnership, where all partners manage and share responsibilities, or a limited partnership, where at least one partner manages the business, and others contribute capital but have limited involvement.

- Limited Liability Company (LLC): An LLC combines a corporation’s and a partnership’s benefits. Owners have limited liability, meaning they’re only responsible for their investment.

- Public Limited Company (PLC): A PLC allows companies to raise capital by issuing shares to the public. Shares can be traded on stock exchanges, and owners have limited liability. A PLC must have at least seven shareholders and a board of directors.

- Non-Profit Company: Non-profits are formed for charitable or social causes and don’t aim for profit. Any surplus is reinvested into the organization to further its mission.

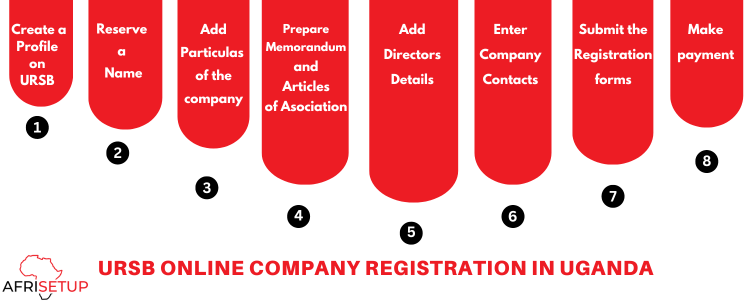

How to Register a Company in Uganda

Whether starting a small business or establishing a larger enterprise, understanding the steps and requirements for registering a company in Uganda is crucial for legal compliance and business growth. This guide will walk you through the essential steps to register your company online.

Step 1: Create a URSB Profile

Before proceeding with company registration in Uganda, you must sign up using your ID or Passport number on the portal.

Step 2: Conduct a URSB Name Reservation

- Conduct a search to ensure your 3 proposed company names are unique and available.

- Submit an application for name reservation. This usually takes 1-3 working days.

- Pay the applicable fee for name reservation.

Step 3: Prepare Company Documents

Certified Copies of the Memorandum and Articles of Association (MAA): Choose to adopt the standard template or upload a custom version. Below is a detailed overview of the essential MAA company forms and their requirements:

- Company Form A1 – Statement of Nominal Capital. It is essential during the initial registration of a company in Uganda. It must indicate the company’s share capital, including the number, class, and nominal value of the shares. The form must be dated, signed by the person filing it, and duly witnessed.

- Company Form A2 – Declaration of Compliance with the Companies Act No. 1 of 2012. It confirms that the company complies with the Companies Act No. 1 of 2012. It must be signed by the declarant, dated, and witnessed by a Commissioner for Oaths.

- Company Form 7 (CR7) – Particulars of Directors and Company Secretary. It captures the details of the company’s directors and company secretary. It should be signed by one of the directors and the company secretary.

- Company Form 9 – Notice of Situation of Business. It declares the official location of the company’s principal office. It is required during the initial registration but must be filed within 21 days of registration if not submitted earlier. A director and the company secretary must sign the form.

Step 4: Submit Registration Documents

Upload documents via the URSB online portal. Alternatively, you can submit them physically to the URSB offices.

Step 5: Pay URSB Company Registration Fees

- Local Company with Share Capital up to UGX 5 Million: Minimum fee of $20.

- Company with Share Capital Over UGX 5 Million: Registration Fee: 1% of the share capital plus Stamp Duty: 0.5% of the share capital.

Step 6: Obtain a Certificate of Incorporation

After approval, URSB will issue a Certificate of Incorporation, confirming your company is legally registered.

After registration, to make the company fully fledged, you will need to consider the following:

- Tax Identification Number (TIN)

- National Social Security Fund (NSSF) if employing staff

- A company bank account

- Company and directors’ tax registration

- Business License

- Any other industry-specific license

Other Relevant Forms related to company registration in Uganda

- Company Form 10 – Notice of Change of Registered Office. Notifies URSB about any changes to the company’s registered office address. A director and the company secretary must sign it.

- Company Form 13 – Return of Allotment of Shares. Notifies URSB of any shares allotted after incorporation. It should specify the shareholders’ names, number of shares, and share values. A director and company secretary must sign it.

- Company Form 20 – Notice of Appointment or Resignation of Directors/Secretary. Notifies URSB of any changes in company leadership, including the appointment or resignation of directors or secretaries. A director and the company secretary should sign it.

- Beneficial Ownership Information Form. Discloses information about individuals who have significant control over the company. It is mandatory for all companies and must be updated as changes occur.

Registration of a Foreign Company in Uganda

Foreign companies that have already been incorporated in their home countries must follow specific steps to establish their presence in Uganda. To legally operate in Uganda, such companies must register with the Uganda Registration Services Bureau (URSB).

Here are the documents required to register a foreign company:

1. Certified copies of the Memorandum of Articles of Association, charter, constitution, and the Certificate of Incorporation from the country of origin, all duly witnessed

- Form 24: Details of Directors and Secretary

- Form 13: Statement of all current charges

- Form 25: List of names and addresses of persons residing in Uganda who are authorized to accept service on behalf of the company

- Form 26: Address and principal office of the company in Uganda

Ensure all required documents are well-organized and obtain assessment forms from the URSB office. Pay the applicable registration fees. Once the process is complete, the Registrar of Companies at URSB will issue a certificate of registration within two working days at the minimum.

Benefits of Registering a Company in Uganda

Uganda is a fast-growing economy with favourable business conditions. Here are some key reasons to register a company in Uganda:

1. Legal Recognition

It gives your company legal recognition, which aids in the protection of your brand and assets.

2. Access to Funding

It makes you eligible for loans and investments from financial institutions and other investors focusing on funding companies registered in Uganda.

3. Reduced Personal Liability

Incorporating your company as a separate legal entity decreases your liability for business debts and obligations.

4. Credibility

You gain customer, supplier, and partner trust by demonstrating your dedication to your business.

5. Tax Benefits

Your company becomes eligible for specific tax incentives depending on the industry, lowering your tax liability and enhancing your bottom line.

6. Opportunities for Expansion

It allows you to access both the local and regional markets.

Why Choose Afrisetup for Company Registration in Uganda

1. Saves You Time

Afrisetup has been in this business for a long time. Through our experience, we are keen to prepare and submit the proper paperwork to avoid numerous back-and-forths with the Registrar of Companies in Uganda.

2. Ease of Compliance

We help you choose the best type of entity and ensure that you process the right registrations for ease of compliance in the short and long run.

3. Access to Our Network of Potential Clients and Partners

We are always happy to recommend your company to potential clients and partners, making it easy for your business to hit the ground running after the company is set up.

4.Confidentiality

All the information received from our clients is only used for company registration in Uganda, and we have internal systems to ensure that it is not disclosed to any unauthorized person.

FAQs (Frequently Asked Questions)

The process takes about 7 days to complete. Tax registration and bank account opening take 14 days, totaling 21 working days.

The minimum fee for a local company with share capital up to UGX 5 million is $20. For share capital over UGX 5 million, the registration fee is 1% of the share capital, plus a 0.5% stamp duty.

Yes, foreigners can register companies in Uganda as sole proprietors, partnerships, or limited liability companies. However, specific sectors may have restrictions or require special permits for foreign ownership

A private company should have at least one director, a public company with at least two directors, and a single-member company with two nominee directors, one as a nominee director and the other as an alternate nominee director.

Visit the URA website and navigate to the e-services section. Under the “Register for Tax” option, select “Instant TIN” for individual taxpayers. Fill in the required information accurately and click “Submit” to complete the application process.

The Uganda Registration Services Bureau offers a free online name search tool on its Business Registry Services (BRS) website. Here’s how to use it:

1) Visit the URSB BRS website: [search company name Uganda on the Uganda Registration Services Bureau website at brs.ursb.go.ug]

2) Enter the company name you want to verify in the “Name to Check” field.

3) Click “Check.”

In Uganda, a private limited company must have at least one shareholder, with a maximum of 50 shareholders allowed.

Reserve a company name with URSB, prepare the required documents, obtain a Tax Identification Number (TIN), submit your application to URSB, and receive a Certificate of Incorporation

You must first apply for the name reservation by clicking the URSB link and filling out the online form before submitting it

Yes, you can register your company name online in Uganda through the URSB website. Visit the URSB site, go to “E-Services,” select “Business Registration,” choose “Name Reservation,” and complete the application form.

Yes, you’ll need to provide a physical address for your company’s registered office in Uganda. This address will be used for official correspondence and legal purposes.

A beneficial company owner in Uganda is a natural person who has ultimate control or ownership of the company or conducts transactions on its behalf.

A beneficial owner of a company in Uganda is a natural person who has ultimate control or ownership of the company, or who conducts transactions on its behalf.

You need to conduct an official search on the URSB website. The URSB maintains records of all registered businesses in Uganda. You can check your company’s status by visiting their offices or using their online search portal

There is no minimum share capital requirement for a Private Company in Uganda, particularly following the Companies Act 2012.

Conclusion

Company registration in Uganda is a straightforward process with the proper guidance. Whether you’re a local entrepreneur or a foreign investor, having a legally registered company enhances credibility and provides access to business opportunities. Partner with us to ensure a smooth and compliant registration process