Starting a company in Kenya can be an exciting and rewarding experience, but it can also be daunting if you don’t know where to start. It involves navigating through various legal requirements and procedures set forth by the Kenyan government. It is essential to comprehend the different legal structures available and the steps involved in the company registration in Kenya to ensure compliance and legitimacy.

Here is an overview of how to register a company in Kenya to help make the remote company registration process easier for potential investors.

Companies Registered in Kenya

Before choosing company registration services in Kenya, selecting the appropriate legal structure that best suits your business goals and objectives is essential. Here are some of the registered Companies in Kenya

1. Sole proprietorships

Sole proprietorships / Business Names are often registered by Kenyans looking to operate a small business using a name other than their own. There is no legal separation between the owner and the business. Hence, all the liabilities fall on the business owner, which makes it a high risk for personal assets if anything goes wrong.

2. Partnership

Partnerships involve two or more individuals pooling resources together to run a business. Businesses registered as a partnership are similar to sole proprietorships in that all liabilities fall on the individual partners.

3. Limited Liability Partnerships

The New Companies Act provides for the registration of limited liability partnerships. The setup is the same as that of a general partnership; the only difference is that the partners’ liability is limited, reducing their exposure.

4. Limited Liability Companies (LLCs) | Private limited company registration in Kenya

Limited liability companies (LLCs) are Kenya’s most common business entities because they are easy to set up, comply with, and protect owners from personal liability. The New Companies Act allows for sole owners in limited liability companies. The owners of an LLC can be natural or legal persons of Kenyan or foreign origin.

An LLC offers a straightforward process with minimal legal complications for those interested in private company registration in Kenya.

5. Branch Companies in Kenya

Foreigners looking to do business in Kenya can register a branch of their foreign company in Kenya. The major difference between a branch company and an LLC registered by foreign owners in Kenya is that the Branch company will be regarded as a foreign entity and hence attract a slightly higher corporate tax.

6. Companies Limited by Guarantee

These are legal entities usually set up to operate as non-profits. They enjoy all the advantages of a legal person in Kenya.

7. Public companies in Kenya

Registration of a public company in Kenya requires a minimum of 7 shareholders and two directors. The company does not have a restriction on the maximum number of shareholders, and it can sell its shares to the public. Registering a public company in Kenya follows the same process as registering a private company.

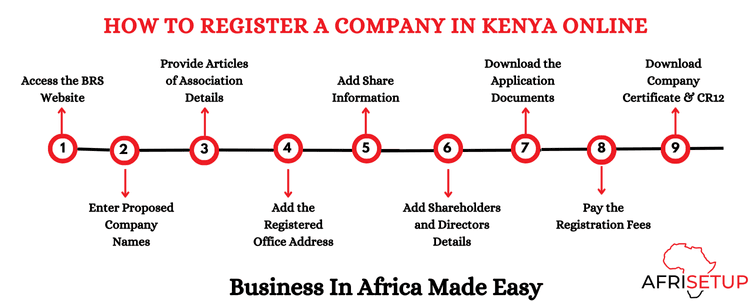

How to Register a Company in Kenya Online

Access the Business Registration System (BRS) through your eCitizen account. The process involves providing company details, uploading the required documents, and making the necessary payments online.

Process of Company Registration in Kenya

1. Access the BRS website:

- Visit the eCitizen website

- Log in to your eCitizen account or sign up if you don’t have one.

- Navigate to the Business Registration Service

- Click on make an application

- Click the Apply Now button under the Private Limited Company option.

2. Enter Proposed Company Names: Add 3 – 5 company names in the order of priority. The First available name will be automatically assigned to your business.

3. Provide Articles of Association Details: The following information is required:

- Choose whether to adopt Model Articles of Association or submit custom Articles.

- Indicate whether the company’s objects are regulated or not.

- Describe the Nature of Business.

- Select the Primary Business Activity.

- Specify the Accounting Period End Month.

- Enter the estimated Start Date, Number of Employees, and Annual Turnover.

4. Add the Registered Office Address: Here, you will add:

- The county

- District

- Locality

- Name of the building,

- Road

- Postal address

- Postal code

- Mobile number

- Company email address

5. Add Share Information: Here, you choose the share category and enter the number of shares and the value of each share.

6. Add Shareholders and Directors Details: Here you can enter the following:

- Name

- Gender

- Date of birth

- Nationality

- ID/passport number

- Email address

- Phone number

- Postal address

- Place of residence

- Occupation

- Number of shares taken and the beneficial ownership details

- Passport size photo

- Attach a copy of the travel passport (For foreigners)

7. Download the application documents: Download, sign, and upload these signed documents to the BRS website:

- CR1 – Shows the list of Directors in the company

- CR2 – Shows the list of shareholders in a company

- CR8 – Shows the addresses of the directors

- BOF 1 – Used to declare the beneficial owners of a company

- Statement of Nominal Capital – Captures the share capital of the company.

8. Pay the registration fees: The government fee ranges from KES 10,750 (Approximately USD 100) to KES 25,000 (Approximately USD 195), depending on the business type and nominal capital. Payment can be made via:

- Bank transfer

- M-Pesa

- Debit/credit card

9. Download the Company Registration Certificate and Cr12: Upon approval (within 7 working days), you will be able to download:

- Certificate of Incorporation

- CR12 (Company Extract)

This guide ensures you meet all the legal requirements to register a company in Kenya efficiently.

After Successfully Finishing the Process of Company Registration, do the following:

- Obtain a KRA PIN and register for the relevant tax obligations: Register for a Kenya Revenue Authority (KRA) PIN to fulfil your tax obligations.

- Open a Corporate Bank Account: You can open a company bank account in one of the many commercial banks in Kenya.

- Register for NSSF and SHA: If the company has employees, you should register with these social security and health insurance schemes.

- Get a business permit or License: Here, you process the relevant Business license/permit for your business from the country’s government or regulatory body.

Company Registry in Kenya

The Kenya Registrar of Companies is a government department responsible for company registration in Kenya and regulating and administering companies and business entities operating within the country.

Core Functions:

- Registering a company in Kenya (Private Limited Companies, Public Limited Companies)

- Registering Business Names and Limited Liability Partnerships

- Maintaining records on registrations

- Issuing certificates of incorporation

- Enforcing compliance with relevant laws

How Much Does it Cost to Register a Company in Kenya

The cost to register a company in Kenya ranges from KES 10,750 (approximately USD 100) to KES 25,000 (approximately USD 195). The exact amount depends on the type of business and its nominal capital. Additional costs may include name search fees, stamp duty, and professional service fees if using an agent.How Long Does it Take to Register a Company in Kenya?

Company Registration in Kenya for Foreigners

The process of foreign company registration in Kenya is straightforward when handled correctly, but it’s essential to understand the legal requirements, shareholding structure, and necessary permits to avoid delays.

Why Register a Company in Kenya?

Setting up a business in Kenya offers a range of benefits to those looking to invest in the country. From tax incentives and legal protection to access to financing and global visibility, registering a company can open up new opportunities for entrepreneurs.

Here Are the Key Benefits of Registering a Company in Kenya:

Legal Protection

It grants you legal recognition and status as an official entity, which helps protect you from any potential issues relating to contracts or disputes related to ownership. Trademark registration can further enhance this.

Tax Incentives

It makes it easier for your company to take advantage of available tax incentives, such as reduced taxes or various tax exemptions.

Limited Liability

By registering your Company, the liability of its owners is limited, which means any debts incurred by the business cannot be attached to their assets.

Easier Business Expansion

It makes it much easier for your business to expand into new markets or open additional branches without going through complex procedures each time.

Business Visibility

It can help you gain global visibility, which is helpful if you are looking to attract investors or engage in international trade.

Business Reputation

It helps you build a credible reputation with customers and suppliers, assuring them that they are dealing with an official entity.

Credibility with Regulators

It gives you credibility with regulators, as you can access relevant documents easily and quickly compared to non-registered entities. It also makes it easier for companies to comply with regulations.

Why Choose Afrisetup for Company Registration in Kenya

With our assistance, you stand to benefit in several ways, including:

1. Saving you time – We have been in this business for a long time, and through our experience, we are keen to prepare and submit the right paperwork to avoid numerous back-and-forth with the registrar.

2. Saving you Money – We have created a solid partnership to ensure smooth registration, Tax Registration, and bank account opening without the need for you to travel to Kenya, thus saving you Money.

3. Ease of Compliance—We help you choose the best type of entity and ensure that you process the right registration for ease of compliance in the short and long run.

4. Access to our network of potential clients and partners – Once you are our client, we are always happy to recommend your company to potential clients and partners, making it easy for your business to hit the ground running after registration.

5. Confidentiality – All information received from our clients is only used for company registration, and we have internal systems to ensure that it is not disclosed to any unauthorized person.

Tips to Make your Company Registration a Smooth Process

To make the registration process smoother, consider these tips:

1. Engage a Professional or Consultant: Hiring a consultant can help you navigate the complexities of registration.

2. Ensure all documents are accurate and complete: Double-check your documents to avoid delays.

3. Follow up with the Registrar of Companies: Regular follow-ups can help speed up the process.

4. Prepare for Post-Registration Compliance: Plan for post-registration requirements to avoid fines and penalties.

Summary Table for Company Registration in Kenya

| Criteria | Subsidiary Company | Foreign Company |

|---|---|---|

| Time Required for registering a company in Kenya | Approximately 10 days | Approximately 10 days |

| Time to Open a Bank Account | Around 5 days | Around 5 days |

| Eligibility to Invoice and Hire | Within 15 days of registration | Within 15 days of registration |

| Minimum Directors and Shareholders | At least 1 director | Not required |

| 100% Foreign Ownership Allowed | Yes | Yes |

| Ability to Employ Expatriate Staff | Yes | Yes |

| Tax Identification Registration | Mandatory | Mandatory |

| Access to Double Tax Treaties | Yes | Yes |

| Eligibility for Government Tenders | Yes | Yes |

| Access to Trade Financing | Yes | Yes |

| Import and Export Licensing | Yes | Yes |

| Conversion to a Public Limited Company | Possible | Not applicable |

| Work Permits for Foreign Employees | Yes | Yes |

| Multi-Currency Bank Accounts | Available | Available |

Company Registration in Kenya FAQs

No, it is not mandatory to register a business in Kenya. However, it is good practice for ease of doing business, compliance, and ensuring your intellectual property is protected

To register a company in Kenya, visit the eCitizen website and create an account. Navigate to the Business Registration Service and start an application for a Private Limited Company. Propose 3-5 company names. Fill in the required details, including office address and shareholder information. Upload necessary documents like CR1 and CR2. Pay the registration fee (KES 10,750 to KES 25,000). After approval, which takes up to 7 days, download your Certificate of Incorporation and CR12. This process ensures your company is legally registered.

A private company needs at least one director, or it can have as many as outlined in its articles of incorporation. If multiple directors are selected, at least one must be a human. Unless specified otherwise in the articles of incorporation, there’s no restriction on the maximum number of directors.

Yes, every company is required to have a registered office for successful registration. This office must be a physical location where notices and other communications can be received on behalf of the company. However, it doesn’t need to be the location where the company conducts its daily operations

A Cr12 is applied on eCitizen (BRS) by clicking on make application and then choosing the official Search option. Then enter the company name you want to search for, Choose the company you want from the list, enter the applicant’s details, confirm that you have provided all the details, Pay KES 650, and then go ahead and download the Cr12

In Kenya, obtaining a CR12 certificate usually takes 3 to 5 days. The timeline can vary based on the completeness of your application and any necessary approvals.

A CR12 certificate in Kenya is valid for one calendar year, or 12 months, from the date it is issued. Therefore, to maintain compliance, businesses must renew their CR12 certificate before it expires each year.

Each registered private company is required to have at least one individual director. In contrast, a public company must have at least two directors, one of whom must be an individual.

No, a minor cannot be a company director in Kenya. The law states that only individuals at least 18 years old can be appointed directors. Any appointment of a director who is under the age of 18 is considered void.

The company’s management must act swiftly. The remaining directors should notify the Registrar of Companies about the death. The director’s death does not dissolve the company; however, the board may need to appoint a new director to fill the vacancy. Following the company’s articles of association and relevant laws is essential to ensure proper succession and maintain compliance. Legal advice might be necessary to address any potential impacts on the company’s operations and governance

A single individual can own a company. This is known as a sole proprietorship or a one-person company, where the owner serves as both the sole shareholder and the director.

A private company can have a single director. However, a public company or a company limited by guarantee is required to have a minimum of two directors.

Conclusion:

At Afrisetup, we alleviate the hassle of navigating the numerous processes involved in opening a business. Whether you’re a local entrepreneur or a foreign investor, trust us to streamline the process and lift the burden off your shoulders. Focus on building your business while we handle the paperwork for you. Do you need assistance with company registration in Kenya?

Feel free to contact us today for expert advice.