Company registration in Rwanda is a smart move for investors looking to do business in a stable and fast-growing economy. Rwanda offers a friendly business environment and access to a wider regional market through the East African Community and the African Continental Free Trade Area (AfCFTA). With government reforms that have made it easier to start and run a business, the country continues to attract both local and foreign investors.

Wondering how to register a company in Rwanda, the types of companies that can be registered, and the benefits? In this video, we answer all these questions and more, providing expert insights on business registration in Rwanda. Hit play and get all the details!

The Economy of Rwanda

Over the past two decades, Rwanda has undergone a remarkable economic transformation. The country’s Gross Domestic Product (GDP) expanded from approximately $752 million in 1994 to about $9.5 billion by 2018, while GDP per capita increased significantly from $125.5 to nearly $787 during the same period.

Rwanda has maintained a strong and consistent economic performance, recording an average annual growth rate of around 8% over the last 20 years. This momentum was particularly evident in 2019, when the economy posted double-digit growth, reaching 12% in the second quarter and 11.9% in the third quarter.

This sustained growth has had a meaningful impact on social and economic development. Between 2000 and 2017, about one million people were lifted out of poverty, while life expectancy more than doubled, rising from 29 years in 1994 to 67 years by 2016. Economic stability has also improved, with inflation declining sharply from 101% in 1995 to 1.1% in 2018. In addition, domestic tax revenue increased 20 times, and the national budget expanded 14 times over the past two decades.

Online Company Registration in Rwanda

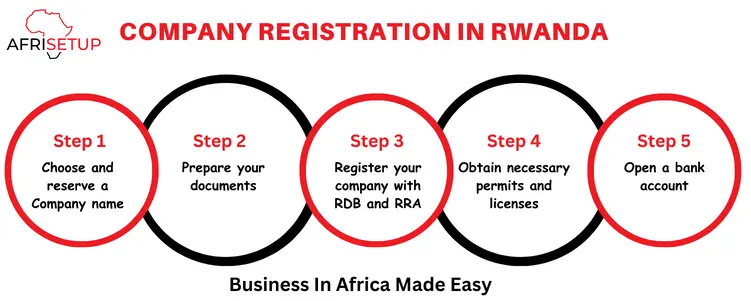

Thanks to a seamless online system, registering a company in Rwanda is now more straightforward than ever. Whether you’re a local entrepreneur or a foreign investor, the Rwandan government provides a digital platform through the Rwanda Development Board company registration system that simplifies business registration. Follow these steps:

Step 1: Choose and Reserve a Business Name

Select a unique name for your company that has not been used in Rwanda. You can check and reserve a business name through the Rwanda Development Board (RDB) website. When making a selection, keep in mind that the Office of the Registrar General in Rwanda will not reserve or authorize a company name if it:

• Violates any Rwandan laws

• Misleads or deceives the public

• Is regarded as insulting or against ethical conduct.

• Is similar to or confusingly comparable to an already registered name

Step 2: Prepare Your Documents

When starting a company, preparing the documents according to the specific requirements to register a company in Rwanda is essential. Here is a checklist to guide you:

• Articles of Association: Official document detailing the company’s objectives, organizational structure, and internal rules.

• Identification Documents: Copies of IDs or passports for all directors and shareholders.

• Proof of Registered Office: Evidence of the company’s official business address.

• Proposed Company Names: A list of three preferred names for the company.

• Share Apportionment Percentage: The allocation percentages of shares among shareholders.

• Business Activities: A description of the company’s main operations.

Step 3: Obtain a Certificate of Incorporation

The Rwanda Development Board (RDB) will consider your application after you submit all of the documentation indicated in Step 2 and pay the required fees.

Once the Registrar General confirms that all legal requirements have been met, the office will issue a Certificate of Incorporation within six (6) hours. This certificate proves that your company is officially registered and legally recognized. After acquiring it, your company is entirely founded and can begin activities immediately.

Step 4: Register Your Company with the Rwanda Revenue Authority

After opening a company in Rwanda, you must register for taxes with the Rwanda Revenue Authority (RRA) to facilitate tax payments and business transactions.

Step 5: Obtain Necessary Permits and Licenses

After completing all the necessary processes for company registration in Rwanda, depending on the nature of your business, you may need to seek extra permits and licenses from the relevant authorities.

Step 6: Open a Bank Account

To perform business activities, you must open a bank account for your company. Currently, there are 16 commercial banks from which to choose.

Here are the requirements for registering a foreign company in Rwanda:

• A notarized power of attorney to represent the company locally.

• Notarized copies of the company’s Memorandum and Articles of Association.

• A certificate of registration/incorporation from the home country (notarized).

• A notarized resolution authorizing the opening of a branch in Rwanda.

• Passports and addresses of all shareholders, directors, and beneficial owners.

• A list of directors residing in Rwanda (at least one required).

• A registered office address in Rwanda.

• Contact information (email and phone) for the local representative and parent company.

• Tax Identification Number (TIN) application for the branch.

• Notarized translations of any documents not in English or French.

Let Afrisetup assist you with with company registration in Rwanda — all from the comfort of your home country.

Post-registration Requirements for Rwanda Company Registration

After successfully registering a company in Rwanda, there are key compliance steps to follow to ensure smooth operations:

a. Tax Compliance: Rwanda’s tax system is well-structured, with mandatory Value Added Tax (VAT) registration for eligible businesses. Ensure timely filing of tax returns to avoid penalties.

b. Business Licensing: Licenses must be renewed periodically. Continually monitor expiration dates to maintain compliance.

c. Employment Obligations: Employers must register employees with the Rwanda Social Security Board (RSSB) and adhere to labor laws to ensure workplace harmony.

d. Employment Compliance: Follow Rwanda’s labor laws regarding contracts, working hours, leave, and employee rights.

e. Annual Returns: File annual returns with the Rwanda Development Board (RDB), which include updated financial statements and company information.

f. Annual General Meeting (AGM): If your business is a public company, hold an AGM as the law requires.

Note for Foreign Companies: Most post-registration steps are the same as for local companies, but some documents, such as a notarized Power of Attorney, certified translations, and a local director, are required during registration. Branches may also be required to submit annual summaries of their parent company’s activities.

Types of Companies in Rwanda

Understanding the different company structures is an essential step in company registration in Rwanda. Companies in Rwanda are generally defined into two categories: private and public, each having a distinctive set of legal and practical differences.

According to Rwandan company law, every company is initially considered public unless it states in its incorporation documents that it is private. Understanding these classifications is an important component of satisfying the requirements for Rwanda company registration.

1. Public Companies

Public companies are those that have offered shares to the general public, usually through an Initial Public Offering (IPO), and are listed on one or more stock exchanges. These companies are distinct from state-owned enterprises and are subject to the same rules as publicly traded entities.

Key features include:

• They can raise funds from the public by selling shares or debentures.

• There is no restriction on the number of stockholders.

• Shares are generally transferable without limitation.

Companies are treated as public by default until they seek private status through incorporation. For example, Public Limited Companies (PLCs) can list their shares on the stock market and raise funds from various investors.

2. Private Companies

Private companies operate under stricter conditions than public companies. Due to their simplified compliance needs, private companies are frequently chosen by small- to medium-sized businesses and startups. A corporation with only one shareholder is automatically referred to as private.

Key features include:

• A maximum of 100 shareholders.

• Share transferability restrictions imply that shares cannot be freely sold or transferred without prior approval.

• No public invitation to subscribe to shares or debentures.

Under Rwanda’s Law No. 007/2021 of 05/02/2021 on companies, private companies are typically categorized according to their legal liability and organizational structure. The main types of private companies in Rwanda are:

I. Company Limited by Shares

This is a type of company in which the liability of its members is limited to the number of shares they hold. If the company is wound up, the members will only be liable for the unpaid amount of their shares.

II. Company Limited by Guarantee

This is a type of company in which the liability of its members is limited to the amount they have guaranteed to contribute to the company in the event of its winding up. Non-profit organizations commonly use this type of company.

III. Company Limited by Shares and by Guarantee

This type of company combines the features of a company limited by shares and a company limited by guarantee. Its members hold shares, and their liability is limited to the amount of shares they hold. It also has members who have guaranteed to contribute a certain amount if the company is wound up.

IV. Unlimited Company

This is a type of company where the liability of its members is unlimited. If the company is wound up, the members will be liable for all the company’s debts and liabilities.

V. Protected Cell Company

This type of company can segregate its assets and liabilities into separate cells, each treated as a separate legal entity. This is commonly used in the insurance industry, where each cell can underwrite a different type of risk.

Types of Business in Rwanda: Recommended Company Structures

| Business Type | Recommended Company Type | Notes |

| Small or Medium Enterprise (SME) | Company Limited by Shares | Flexible and most common; offers limited liability for owners. |

| Non-Profit or NGO | Company Limited by Guarantee | No shareholders; ideal structure for non-profit operations. |

| Financial or Insurance Firm | Protected Cell Company (PCC) | Allows separation of assets and liabilities across distinct business cells. |

| Specialized Legal or Financial Entity | Unlimited Company | Suitable for high-risk ventures; members have unlimited liability. |

| Mixed Structure (Rare) | Company Limited by Shares and Guarantee | Combines both models; some liability is limited by the capital invested and some by the guarantee. |

Limited Company Registration in Rwanda Fees | Cost to Register a Business in Rwanda

The Rwanda company registration costs are minimal, with additional expenses depending on the licenses required. Always budget for unforeseen costs. Contact us to get the actual quotation.

Benefits of Registering a Company in Rwanda

Business registration in Rwanda is essential for entrepreneurs looking to establish a legally recognized and credible business. The country offers numerous advantages for startups and investors, making it an attractive destination for business growth. Some key benefits include:

1. Investor-friendly economy

Rwanda is a leading destination for both local and foreign investors due to its political stability, strong economic growth, and supportive business policies — making company registration in Rwanda an attractive and strategic choice for expanding your business.

2. Attractive tax incentives and exemptions

Rwanda offers a wide range of tax incentives to attract investment. These include corporate tax exemptions for companies relocating their headquarters, a reduced corporate income tax rate of 15% for priority sectors such as energy, ICT, transport, financial services, and affordable housing, capital gains tax exemptions for registered investors, and corporate income tax holidays for large-scale projects in strategic sectors including energy, exports, health, tourism, manufacturing, and ICT.

3. Accelerated depreciation

Businesses in tourism, construction, manufacturing, and agro-processing can benefit from accelerated depreciation of up to 50%, allowing faster recovery of capital investments.

4. Free repatriation of capital and profits

Rwanda allows easy repatriation of capital, profits, and assets, offering investors financial security and flexibility.

5. Simple and transparent tax system

Rwanda has a clear tax structure, with personal income tax ranging from 0% to 30%, corporate income tax at 30%, and VAT at 18%.

6. Strong government support for investors

The Investment Code provides incentives, guarantees, and legal protections to promote and safeguard investments.

7. One-stop investment services

The Rwanda Development Board (RDB) acts as a one-stop center, supporting investors with company registration, licensing, and regulatory approvals.

8. Special Economic Zones (SEZs)

Rwanda has established Special Economic Zones that offer preferential policies for industrial, manufacturing, and export-oriented businesses.

Tips to Make Company Registration in Rwanda an Easy Process

When registering a company in Rwanda, proper preparation and attention to detail can help ensure a smooth and efficient process:

1. Prepare all documentation in advance to avoid delays.

2. Familiarize yourself with the RDB portal for online applications.

3. Consult industry-specific experts for tailored advice.

4. Double-check all collected information to ensure it is accurate, including passport photos and contact details.

5. Submit scanned copies of all documents, as the system requires electronic versions.

Frequently Asked Question (FAQs)

Foreigners need a power of attorney, notarized parent company documents, passport copies of shareholders/directors, and a list of directors in Rwanda.

Steps:

- Visit the RDB website.

- Select “Enterprise Search.”

- Enter a search term.

- Review the results, including name, number, date, and address.

This process helps ensure that a business has completed proper company registration in Rwanda and is legally recognized to operate.

Rwanda is a good place to do business, with stable politics, vigorous growth, and a pro-business environment. It ranks 2nd in Africa for ease of doing business.

Rwanda has abolished the statutory costs for most types of businesses, making it affordable for entrepreneurs to start a company.

To dissolve a company in Rwanda, obtain a removal certificate from the Registrar General at the Rwanda Development Board (RDB). This applies if the company is solvent and has no pending creditor claims.

Yes, foreigners can do business in Rwanda without restrictions and are granted the same rights as local investors.

The registration process typically takes 5 to 7 days, depending on the complexity of your business structure and the completeness of your documentation

Rwanda allows wholly foreign-owned companies, though some sectors may have restrictions or require special permits.

Business registration in Rwanda is free of charge. There are no registration fees required to establish a company in the country.

Starting a business in Rwanda as a foreigner is straightforward, with a streamlined process conducted online via the Rwanda Development Board (RDB) portal. Simply submit your application and necessary documents through the online platform for efficient processing.

Conclusion

Registering a company in Rwanda is straightforward, thanks to the efficient online registration system and supportive business environment. As trusted experts, we help you navigate each step and ensure you choose the ideal legal structure for your business’s success.

Do you need assistance with company registration in Rwanda? Feel free to contact us to get started.