- By afrisetupconsultants

- Uncategorized

- 0 Comment

Business registration in Tanzania – Tanzania fosters an economically stable environment characterized by a low inflation rate of 4.04%, which promotes predictability for businesses. This stability, coupled with consistent economic growth averaging 6-7% annually, is primarily driven by key sectors including agriculture, mining, manufacturing, construction, and services, making Tanzania an attractive destination for foreign investors seeking low-risk opportunities.

Are you a foreigner looking to start a business in Tanzania? Don’t hesitate, Afrisetup is here to help you throughout the process of company registration in Tanzania. Call us today to establish your presence in this growing economy.

BRELA in Tanzania| Business registration and licensing agency Tanzania

BRELA oversees business registration and licensing in Tanzania, operating under the Ministry of Industry and Trade. It manages the registration of companies, partnerships, and sole proprietorships, and issues a range of business licenses and permits.

BRELA’s responsibilities encompass:

- Company Registration: Managing the registration process, including incorporation applications and issuing certificates.

- Business Name Registration: Facilitating the registration of business names for sole proprietors and partnerships.

- Intellectual Property Registration: Handling the registration of trademarks, patents, and industrial designs.

- Business Licensing: Granting licenses and permits across various sectors like manufacturing, construction, transportation, hospitality, and professional services.

- Regulatory Compliance: Ensuring businesses adhere to registration and licensing laws, providing guidance, conducting inspections, and enforcing regulations.

- Information Services: Providing information on registration procedures, licensing requirements, and intellectual property rights, and maintaining a registry of businesses.

Businesses in Tanzania are required to register with BRELA and obtain the necessary licenses and permits. BRELA plays a crucial role in supporting business registration, encouraging investment, and upholding regulatory compliance.

BRELA Tanzania Online Registration | Business name registration in Tanzania

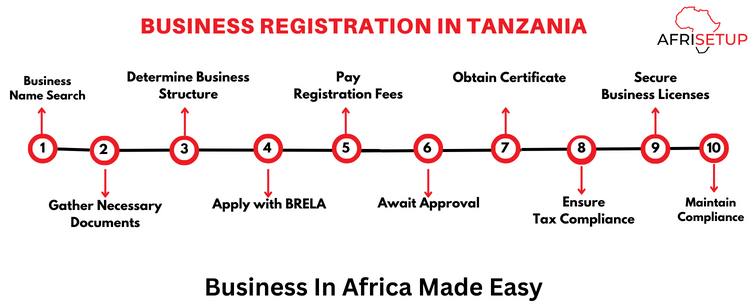

Business registration process in Tanzania typically includes:

- Conduct a Business Name Search: Before registering, ensure your desired business name is available and not already in use.

- Gather Necessary Documents: Collect required paperwork, including owner identification, and for companies, a memorandum and articles of association.

- Determine Business Structure: Decide on the legal framework, such as sole proprietorship, partnership, limited liability company, or corporation.

- Apply with BRELA: Submit your registration application to the Business Registrations and Licensing Agency (BRELA), either online via the e-registration portal or in person at their office.

- Pay Registration Fees: Settle the required fees as per BRELA’s regulations, which may vary based on business type and size.

- Await Approval: After submission and payment, await approval from BRELA, with processing times subject to their workload and efficiency.

- Obtain Certificate: Upon approval, receive a certificate of incorporation or business registration from BRELA, serving as legal proof of your business’s existence.

- Ensure Tax Compliance: Obtain a Taxpayer Identification Number (TIN) and register for relevant taxes with the Tanzania Revenue Authority (TRA) to meet tax obligations.

- Secure Business Licenses: Depending on your business activities, acquire any additional licenses or permits required by regulatory authorities or local government bodies.

- Maintain Compliance: Stay compliant with legal and regulatory requirements by filing annual returns, renewing licenses, and meeting tax obligations.

Business registration act Tanzania

The primary law regulating business registration is the Business Registration and Licensing Act (Cap. 212). This legislation delineates the procedures and prerequisites for registering various business entities, encompassing Limited companies, partnerships, sole proprietorships, and branches of foreign corporations. It establishes the Business Registrations and Licensing Agency (BRELA) as the governing body entrusted with overseeing business registration and licensing procedures within Tanzania. The act addresses key areas such as business name registration, incorporation processes, registration fees, adherence requirements, and repercussions for non-compliance. Additionally, it includes provisions for online business registration and defines the legal framework governing business activities and transactions across the country.

Business registration in Tanzania requirements

Business registration requirements in Tanzania vary depending on the type of business entity you intend to establish. However, some general requirements typically apply across different business structures. Here are the common requirements for business registration:

- Business Name: Choose a unique business name and conduct a name search to ensure its availability.

- Legal Structure: Determine the legal structure of your business, such as a sole proprietorship, partnership, limited liability company (LLC), or corporation.

- Registered Address: Provide a physical address for your business premises within Tanzania.

- Ownership Information: Submit identification documents of the business owners, partners, or shareholders, including copies of passports or national identification cards.

- Memorandum and Articles of Association: Prepare and submit the memorandum and articles of association if registering a company, outlining the objectives, structure, and regulations governing the company’s operations.

- Registration Forms: Fill out the required registration forms provided by the Business Registrations and Licensing Agency (BRELA) or relevant authority.

- Registration Fees: Pay the applicable registration fees as stipulated by BRELA or the relevant regulatory body.

- Tax Registration: Obtain a Taxpayer Identification Number (TIN) from the Tanzania Revenue Authority (TRA) for tax compliance purposes.

- Business License: Depending on the nature of your business activities, you may need to obtain additional licenses or permits from relevant government ministries, departments, or agencies.

- Compliance with Regulations: Ensure compliance with all legal and regulatory requirements, including labor laws, environmental regulations, and industry-specific regulations.

- Online Registration (Optional): Take advantage of online registration platforms provided by BRELA or other authorized agencies for convenience and efficiency.

Benefits of Business Registration in Tanzania

Registering a business in Tanzania offers numerous benefits, both legally and economically. Here are some of the key advantages:

- Legal Recognition: Business registration grants your enterprise legal recognition, establishing it as a distinct entity separate from its owners. This separation helps protect personal assets in case of legal issues or debts incurred by the business.

- Access to Funding: Registered businesses are often eligible for various forms of financing, including loans, grants, and investment opportunities. Financial institutions and investors typically prefer to engage with registered entities due to the transparency and accountability they offer.

- Business Credibility: Registration enhances your business’s credibility and reputation in the eyes of customers, suppliers, and partners. It signals a commitment to professionalism and compliance with regulatory standards, which can attract more customers and business opportunities.

- Legal Protection: Registration provides legal protection for your business name, preventing others from using the same or similar names within your industry. This safeguard helps establish brand identity and prevents confusion among consumers.

- Tax Compliance: Registered businesses are required to comply with tax regulations, including obtaining a Taxpayer Identification Number (TIN) and filing tax returns. However, registration also opens avenues for tax deductions, incentives, and benefits available to formal businesses.

- Access to Government Contracts: Many government contracts and procurement opportunities are exclusively available to registered businesses. Registering your enterprise enables you to compete for these contracts, potentially leading to significant revenue streams.

FAQs on Business Registration in Tanzania

- How long does it take to register a business in Tanzania? The procedure takes about 10 days after submission of all necessary documents.

- What are the minimum capital requirements for business registration in Tanzania? Tanzania does not impose strict minimum capital requirements for most business entities, making it accessible for small and medium-sized enterprises (SMEs) to register and operate.

- Can foreign nationals register a business in Tanzania? Yes, foreign nationals are allowed to register businesses in Tanzania. However, certain restrictions and regulations may apply, particularly in sectors deemed strategic or sensitive to national interests. Contact us for more info.

- Is it mandatory to have a physical office in Tanzania for business registration? No, but you need a registered address.

- Can I change my business structure after registration? Yes

- What are the tax implications of business registration in Tanzania? Registered businesses in Tanzania are subject to various taxes, including corporate income tax, value-added tax (VAT), and withholding tax. Understanding and complying with tax obligations is essential for legal and financial compliance.

- Are there any tax incentives for newly registered businesses in Tanzania? Corporate Income Tax Exemptions: Newly registered businesses may be eligible for corporate income tax exemptions for a certain period, particularly if they operate in priority sectors or designated economic zones. Investment Allowances: Businesses investing in certain qualifying assets or activities may benefit from investment allowances, allowing them to deduct a portion of their capital expenditures from taxable income.

- What business is good to do in Tanzania? Agriculture and Agribusiness, Tourism and Hospitality, Renewable Energy, Construction and Real Estate, Information and Communication Technology (ICT).

- What is the fastest-growing business in Tanzania? Identifying the “fastest-growing” business in Tanzania can be subjective and may vary depending on various factors such as market trends, economic conditions, and individual business strategies. However, several sectors have shown significant growth potential and opportunities for entrepreneurs in Tanzania. Agriculture and Agribusiness, Tourism and Hospitality, Renewable Energy, Construction and Real Estate, Information and Communication Technology (ICT).

- Is it necessary to engage a local representative or partner for business registration in Tanzania? While not mandatory in all cases, having a local representative or partner can facilitate the registration process and navigate cultural and regulatory nuances effectively.

- What are the key documents required for business registration in Tanzania?

- Three preferred names of the proposed company

- Valid Travel passport copies of all the Directors/Shareholders

- Notarized Copy of the Parent Company Certificate of Incorporation and a list of all beneficial owners of the parent company (If Parent Company will be a shareholder in the subsidiary)

- Passport size photographs of all the Directors and Shareholders

- Postal, physical and e-mail address, Telephone number and occupation of all Shareholders/directors of the proposed company

Conclusion;

Well, navigating through the paperwork and legalities involved in the registration process can be quite overwhelming. At Afrisetup, we specialize in providing comprehensive support and assistance with company registration processes.

With our expertise and experience in this field, we can help simplify the entire process for you, reducing the lengthy paperwork and ensuring that everything is handled efficiently. Our team is well-versed in the legal requirements and procedures involved in business registration, and we can guide you through each step of the way. Reach out to us today!