Looking to start a company in Tanzania? You are on the right track to capitalize on the country’s growing economy and business opportunities. Company registration in Tanzania is now more straightforward than ever, thanks to government efforts to simplify the process. Whether launching a startup or expanding your operations, Tanzania provides a supportive environment to help your business thrive.

Registering a company in Tanzania involves a few essential steps, documents, and decisions. In the video below, we walk you through the company registration procedures in Tanzania, from gathering the right paperwork to choosing the best type of company for your goals. You’ll also learn about the key advantages of setting up a business in Tanzania.

Types of Registered Companies in Tanzania

Before exploring the company registration procedures for registration of a company in Tanzania, it’s essential to understand that each type serves a unique purpose and operates under specific legal frameworks. Here are the Tanzania registered companies:

Private Limited Company:

A private limited company is an independent legal entity owned by shareholders. It provides limited liability, which safeguards shareholders' assets in the event of the company's debts. The company mandates the presence of at least one director and can accommodate a maximum of 50 shareholders.

Public Limited Company:

A public limited company is an independent legal entity that benefits from limited liability. It can offer its shares to the general public and trade them on the stock exchange. A minimum of three directors is required, and there is no restriction on the number of shareholders that can be involved.

Company Limited by Guarantee:

A company limited by guarantee is a form of business entity that does not have share capital or shareholders. Instead, it consists of members who offer a guarantee to cover the company's liabilities. Non-profit organizations frequently utilize this type of company.

Unlimited Company:

In an unlimited company, the liability of its members is not restricted. The members bear personal responsibility for the company's debts and obligations, lacking the safeguard of limited liability.

Branch Office:

A branch office is a continuation of a foreign company's operations in Tanzania. It is not regarded as an independent legal entity but is seen as an essential component of the foreign company.

Partnership:

A partnership is established when two or more individuals or entities collaborate to conduct a profit-oriented business. It can take the form of a general partnership, where all partners assume unlimited liability, or a limited partnership, which involves both general and limited partners with varying degrees of liability.

Sole Proprietorship:

A sole proprietorship is a business owned and managed by a single individual. The owner bears unlimited liability for the company's debts and obligations, which implies that their assets are vulnerable in the event of company liabilities.

Tanzania Company Act

The Tanzania Companies Act is the principal legislation governing the formation, registration, management, and dissolution of companies in Tanzania. Understanding its provisions is essential for compliance and successful business operations. It applies to both local and foreign companies operating within Tanzania.

Tanzania Registrar of Companies

The Business Registrations and Licensing Agency (BRELA) is the government entity responsible for overseeing company registration. It operates under the Ministry of Industry and Trade, and serves as the Registrar of Companies. To register a company in Tanzania, individuals or entities must adhere to the procedures and regulations established by BRELA.

Here are the roles played by the Tanzania company registry:

1. Company Registration in Tanzania

The Registrar is responsible for registering new companies and ensuring that businesses are legally recognized and compliant with the Companies Act of Tanzania.

2. Maintaining Company Records

The registry keeps official records of all registered companies in Tanzania. This includes updates to company names, registered addresses, directors, shareholders, and share capital structures.

3.Monitoring Legal Compliance

The Tanzania company registry monitors whether companies comply with relevant business laws and regulations, helping to ensure transparency and accountability in the corporate sector.

4. Company Dissolution and Liquidation

The Registrar manages the official process of dissolving and liquidating companies that are no longer operational or financially viable.

5. Regulatory Enforcement

The registry has the authority to enforce provisions of the Companies Act and other applicable laws, ensuring companies operate within the legal framework.

6. Public Access to Company Information

As a centralized source of business data, the Tanzania company registry provides public access to important company information, supporting due diligence and informed decision-making.

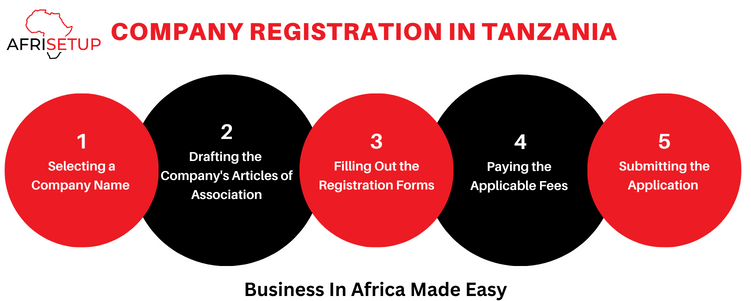

How to Register a Company in Tanzania

Online company registration in Tanzania simplifies the process for individuals and businesses to register a company electronically. This guide outlines the necessary steps for registering a company in Tanzania.

1. Select a Business Name

Choose a distinctive and memorable name that reflects your business activities. Ensure that the name is unique and not already registered or too similar to existing businesses. You can check availability through the Business Registration and Licensing Agency (BRELA) website.

2. Draft the Memorandum and Articles of Association

Prepare the foundational documents that define your company’s structure and purpose:

• A Memorandum of Association outlines business objectives and shared structure.

• Articles of Association define governance, director duties, and shareholder rights.

• All shareholders and directors must sign these documents.

3. Nominate Directors and Shareholders

Registering a company in Tanzania requires appointing directors and shareholders based on your company structure.

• Private Limited Company (LTD): Minimum of 1 director and 1 shareholder, with a maximum of 50 shareholders.

• Public Limited Company (PLC): Requires at least 3 directors and 7 shareholders.

• Foreign Directors: Must submit certified passport copies.

Each director and shareholder must provide the following:

• Full names and contact details

• Recent passport-size photographs

• Valid identification (national ID or passport)

Note: To meet BRELA’s compliance standards, shareholding ratios, and ownership structure must be clearly defined in the Memorandum and Articles of Association (MoA & AoA).

4. Prepare and Submit Registration Documents Online

Use BRELA’s Online Registration System (ORS) to upload your documents. Requirements differ slightly between local and foreign companies:

For Local Companies:

• Approved company name reservation

• MoA and AoA

• Directors’ and shareholders IDs, and photos

• Form 14B (Declaration of Compliance)

• Physical and postal address of the company

• Integrity pledge form

For Foreign Companies:

• Certified copies of the Certificate of Incorporation, MoA & AoA from the home country (translated into English if needed)

• Board resolution authorizing operations in Tanzania

• Appointment letter for a local representative

• Statement of charges (on any Tanzanian assets)

• Principal address (home country) and physical address in Tanzania

• Form 434- Outlines the company’s local address, list of directors, and resident representatives. A Commissioner for Oaths or a Notary Public must sign and certify it.

• Integrity pledge form

5. Pay the Applicable Government Fees

Company registration fees in Tanzania vary based on the type of company and authorized share capital:

• Name Reservation: Approximately TZS 50,000.

• Certificate of Incorporation: Starting from TZS 100,000 (based on share capital)

Please note that these fees do not include our professional services. Payments are made via designated banks or mobile platforms. Always obtain and retain proof of payment.

6. Receive your Certificate of Incorporation

Once your documents are reviewed and approved, BRELA issues a Certificate of Incorporation. This document confirms your company’s legal existence, registration number, and incorporation date. The review process typically takes between 3 and 14 business days.

Post Registration Requirements

After receiving your Certificate of Incorporation, there are a few crucial steps to complete before your company becomes fully operational in Tanzania. Here’s a detailed guide to navigating the post-registration process effectively:

1. Obtain Necessary Business Licenses

Depending on your industry, you may need the following:

• A general business license from BRELA

• Sector-specific licenses (e.g., for healthcare, transport, food service, etc.)

• Compliance with Occupational Safety and Health Authority (OSHA) requirements if your business operates in a high-risk sector—for example, Environmental Impact Assessment (EIA) certificates for industrial projects.

Always check with your local authority or ministry to ensure you meet all regulatory requirements for your specific business type.

2. Open a Corporate Bank Account

You’ll need a Tanzanian corporate bank account to:

• Deposit the company’s initial share capital

• Handle local transactions

• Maintain compliance with Tanzanian financial regulations

Most banks in Tanzania require the following documents to open a business account:

– Certificate of Incorporation

– Taxpayer Identification Number (TIN)

– Memorandum and Articles of Association

– Copies of identification documents for directors and signatories

– Business License

3. Comply with Tax Obligations

As a registered company, you must comply with the Tanzania Revenue Authority (TRA) tax requirements. If your business projects an annual turnover exceeding TZS 100 million, you’ll also need to:

• Submit monthly VAT returns (if applicable)

• Register for withholding tax (if applicable)

• Obtain an Electronic Fiscal Device (EFD) for issuing receipts

• Pay PAYE (Pay-As-You-Earn) for employees

4. Register with the Social Security Fund

Employers in Tanzania must register with the National Social Security Fund (NSSF) or other approved schemes to provide employees with social benefits such as pensions. You’ll need:

– Company registration documents

– TIN certificate

– Employee details

Compliance: Deduct and remit contributions from employees’ salaries monthly to avoid penalties.

5. Draft and execute Employment Contracts

Ensure all employees have legally compliant contracts that specify:

• Roles and responsibilities

• Salaries and benefits

• Working hours and leave policies

6. Register for Workers’ Compensation Insurance

Under Tanzanian labor laws, employers are required to provide workers’ compensation insurance. This protects employees in case of workplace injuries or accidents.

7. Immigration Compliance for Foreign Directors and Employees

If your company hires or includes foreign nationals, ensure that:

• They apply for the correct work permits (e.g., Class A for investors, Class B for professionals)

• They obtain residence permits for long-term stays.

• They comply with Tanzania’s Immigration (Amendment) Regulations, 2023, including using the Interim (Special) Pass, if applicable.

Short-term stays can be managed with a business visa, but this does not allow employment.

8. Establish an Accounting System

Set up a proper accounting and record-keeping system that complies with the International Financial Reporting Standards (IFRS). Maintain accurate income, expenses, assets, and liabilities records and prepare audited financial statements annually, especially if required in your sector.

9. File for Annual Returns with BRELA Tanzania

Every registered company in Tanzania must file annual returns with the Business Registrations and Licensing Agency (BRELA). These returns update the agency on your company’s operational status and must be submitted within 28 days of the Annual General Meeting (AGM). Late filings may result in penalties or possible deregistration.

10. Intellectual Property Protection (Optional)

• Trademark Registration: Protect your brand by registering trademarks with BRELA.

• Patents and Copyrights: Register innovations and creative works as needed.

11. Maintain Statutory Registers

Maintain updated registers of shareholders, directors, charges, and mortgages. Keep minute books for board and shareholder meetings.

12. Report Changes to BRELA

Any change in directors, shareholding, or registered address must be reported within 14 days. Amendments to the Memorandum and Articles of Association must be submitted for approval.

13. Participation in Local Business Associations

Join organizations like the Tanzania Chamber of Commerce, Industry, and Agriculture (TCCIA) for networking and advocacy. Engage with industry-specific organizations for ongoing support and compliance updates.

Tips for a Smooth Registration Process

1. Hire a Local Agent: A local consultant can guide you through the BRELA and TRA requirements.

2. Have Documents Ready: Ensure all paperwork is complete before submission.

3. Use Online Services: BRELA’s digital platform speeds up registration.

4. Comply with Tax Obligations: Registering for TIN and VAT early prevents future penalties.

Company Registration Fees in Tanzania

The cost of company registration in Tanzania includes several components such as statutory fees, consulting fees (if you choose to work with a consultant like Afrisetup), notarization fees, and additional costs related to document preparation and submission. These expenses can vary depending on factors such as your company’s authorized share capital and particular requirements.

Documents Required for Company Registration in Tanzania

Preparing all the necessary documents in advance is essential if you plan to register a company in Tanzania. This will help streamline the registration process and avoid unnecessary delays. Here’s what you’ll need:

• At least 3 proposed company names

• A certified copy of the applicant’s passport or national ID

• Passport-size photographs of directors/shareholders

• Memorandum and Articles of Association

• Details of directors and shareholders (including physical address, phone number, email address, and nationalities)

• Registered physical address of the company in Tanzania

• Taxpayer Identification Number (TIN) application form

• Filled BRELA application forms (as per company type)

Why Register a Company in Tanzania?

Tanzania offers several compelling reasons to start a company:

1. Stable Economy: Tanzania is one of East Africa’s fastest-growing economies, with strong growth in the agriculture, mining, and tourism sectors.

2. Strategic Location: As a gateway to the East African market, Tanzania offers access to a consumer base of over 177 million people.

3. Investment-Friendly Policies: The government actively promotes foreign and local investments through tax incentives and special economic zones.

4. Legal Protection: Registering your company ensures legal recognition, offering credibility and security to business operations.

Benefits of Company Registration in Tanzania

Registering a company in Tanzania offers several advantages for local and foreign entrepreneurs. Here are the key benefits:

1. Limited Liability

Company registration protects your assets by separating them from the company’s liabilities. In case of financial difficulties or legal issues, your risk is limited to your investment in the company.

2. Business Credibility

A registered company boosts your credibility and professionalism, establishing a legal identity that fosters trust with customers, suppliers, and partners. Clients are more likely to engage with registered businesses, viewing them as reliable and trustworthy.

3. Access to Funding

Registered companies enjoy improved access to funding. Banks and financial institutions are more inclined to offer loans or credit to registered businesses. Additionally, you may attract investments and venture capital or qualify for government grants and financial support.

4. Ease of Doing Business

Tanzania has streamlined its business registration process, making it quicker and easier for entrepreneurs to set up and operate their businesses. Initiatives to reduce bureaucracy and provide online registration platforms enhance the business environment.

5. Tax Benefits

Registered companies can benefit from tax incentives and exemptions, including reduced corporate tax rates and tax holidays for specific sectors. These advantages can lead to significant cost savings and promote overall business growth.

Frequently Asked Questions (FAQs)

You will need key documents such as identification for shareholders/directors, a memorandum and articles of association, and a proposed company name. A complete list of documents is available above under “Documents Required for Company Registration in Tanzania.

Yes. Tanzanian law allows the formation of a Single Shareholder Company with limited liability.

Yes, it is possible to register a company in Tanzania remotely. We assist with the entire process, including paperwork, incorporation, and bank account setup.

Yes. There are no restrictions on the nationality of directors, but compliance with industry-specific regulations is essential.

Individuals can register their business names with the Business Registration and Licensing Authority (BRELA), an agency appointed by the Ministry of Trade and Industry. The registered name can be obtained before or after applying for a Tax Identification Number (TIN).

Costs may vary based on company type and services used. On average, registration fees through BRELA Tanzania range from $100 to $300, excluding professional service charges

Typically, the process takes around 2 weeks, depending on application completeness and workload at BRELA.

Use the BRELA Online Registration System (ORS) to verify a company by name or registration number.

The most efficient method is through the BRELA ORS platform with the help of a registration consultant to ensure all documents and steps are correctly handled.

A foreigner can register either a branch or a new company locally. The process can be fully remote.

A company is a separate legal entity owned by shareholders, while a partnership is owned and managed by partners with shared responsibilities.

Requires at least two directors and seven shareholders, with a Tanzanian citizen holding a minimum of 40% ownership.

Shares are purchased through licensed brokers or money managers certified to operate on the Dar es Salaam Stock Exchange.

Submit the NGO A Form No. 1 for local registration or the NGO A Form No. 3 for a Certificate of Compliance for international NGOs.

Conclusion

Company Registration in Tanzania unlocks the country’s thriving business opportunities while providing legal protection, credibility, and funding access. To ensure success, understand the different company types, complete post-registration requirements, and leverage available tax incentives.

Partner with experts like Afrisetup to navigate regulations efficiently for a smooth process. Contact us today to get started!