- By afrisetupconsultants

- Uncategorized

- 0 Comment

Business Registration in Uganda | How to Register a Business in Uganda

Are you looking for answers on how to Register a Business in Uganda? Look no further than this comprehensive guide to business registration in Uganda. Here, we will provide you with a detailed overview of everything you need to know about registering your business in Uganda, including the importance, process, requirements, cost of business registration in Uganda.

URSB Name Search

Step 1. Visit the URSB Portal

Step 2. Type the business name in the search box

Step 3. Click on Check

Once you do this, the system will populate all similar business names. If you find a name that is exactly the same as the name you want to register, then you should find another name or tweak the name a bit since there are high chances of the name been rejected.

Types of Businesses in Uganda

- Sole proprietorship in Uganda: (URSB Registration of Business Name) – This is the simplest form of business registration in Uganda, and it is suitable for small businesses. In a sole proprietorship, there is no legal distinction between the owner and the business. This means that the owner is personally responsible for all the debts and liabilities of the business.

- Partnership: A partnership is a type of business in Uganda that involves two or more people who share ownership of the business. Partnerships can be general or limited. In a general partnership, all partners are jointly responsible for the debts and liabilities of the business. In a limited partnership, there are two types of partners: general partners who manage the business and are personally liable for its debts and liabilities, and limited partners who only invest in the business and have limited liability.

- Limited liability company (LLC): Company Registration in Uganda comes with the liability protection of a corporation with the tax benefits of a partnership. In an LLC, the owners (referred to as members) have limited liability, which means that they are not personally responsible for the debts and liabilities of the business. This type of company must have at least two shareholders.

- Single Member Company in Uganda: This business type is the same as an LLC only that the company is owned by one shareholder. The sole shareholder then becomes one of the directors and it is mandatory for them to appoint a nominee director to act on their behalf incase they are incapacitated.

- Company limited by guarantee. This is a corporate body registered for the sole reason of running non profit making activities.

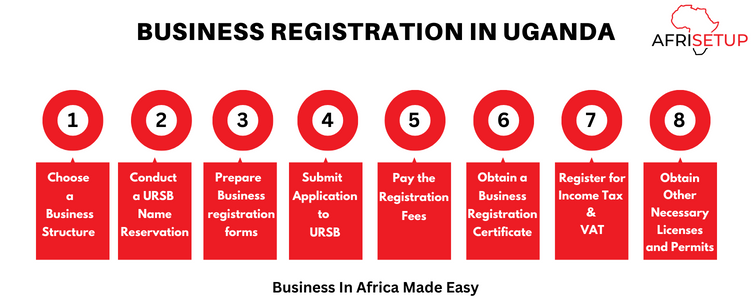

Business Name Registration in Uganda | Online Business Registration in Uganda |Business Registration Process in Uganda

- Choose Your Business Structure – The first step in Business registration in Uganda is to decide on the type of structure you want for your business. The most common structures are sole proprietorship, partnership, and limited liability company. Each structure has its benefits and drawbacks, so it’s important to research and choose the one that best suits your business needs.

- Conduct a URSB Name Reservation – Once you have decided on the business structure, you need to reserve a name for your business. it normally takes a maximum of 3 days to have the name reserved after paying the URSB name reservation fees

- Prepare Your Business registration forms in Uganda – Each business entity has the prescribed registration forms. Make sure the forms are duly completed and signed before submission.

- Submit Your Application to the URSB – After preparing all the necessary documents, you can now submit your application to the URSB for registration.

- Pay the Registration Fees – You will be required to pay the registration fee to the URSB. The amount varies depending on the type of business structure you choose. It’s important to note that the fees are non-refundable.

- Obtain a Business Registration Certificate – After successfully registering your business, you will receive a Business Registration Certificate from URSB. This certificate is proof that your business is legally recognized and registered in Uganda.

- Register for Income Tax and Value Added Tax (VAT) – All businesses in Uganda must register for the income tax and if your business is eligible for Value Added Tax (VAT), you need to register for the same as well. This is mandatory for businesses whose annual turnover exceeds UGX 50 million.

- Obtain Other Necessary Licenses and Permits – Depending on the nature of your business, you may need to obtain other licenses and permits from various government agencies, such as the National Environment Management Authority (NEMA), Ministry of Health, and Ministry of Trade, Industry and Cooperatives.

Requirements for Registering a Business in Uganda

- At least 3 proposed business names

- A description on the nature of business and objectives of the business.

- The names of the business owners.

- Contact information of the business owners – Email address, Telephone number, postal address and residential addresses.

- Copies of national ID / Passport Bio-data and passport photo of the business owners.

Benefits of Registering a business in Uganda- Business Name Protection: Registering your business provides you with exclusive rights to your business name, preventing others from using the same name in the same industry.

- Access to Finance: Business registration allows entrepreneurs to access credit, loans, and other financing options that may not be available to unregistered businesses. Lenders are more likely to lend to registered businesses since they are seen as more legitimate and trustworthy.

- Business Opportunities: Registered businesses have more opportunities to win contracts, tenders, and grants since they are seen as more credible and trustworthy.

- Tax Benefits: Registered businesses enjoy tax benefits such as tax deductions, reduced tax rates, and access to tax incentives, which can help them save money and grow their businesses.

- Branding: Registering your business helps you establish a professional image and brand identity that can attract customers and help you stand out from the competition.

Conclusion

After business registration in Uganda, you will be legally recognized as a legal business entity and can begin operations. The process can be completed in a few steps, including reserving a business name, registering with URSB and obtaining a business Tax Identification Number (TIN). It is important to ensure that all necessary documents are provided, and all fees are paid to avoid delays or rejection of the application. Contact us today for help in business registration in Uganda

Common FAQs About Business Registration in Uganda

The business registration process in Uganda takes approximately 1-7 days, depending on the type of business structure you choose

Yes, foreigners can register businesses in Uganda. However, they must comply with all the necessary regulations and requirements.

The cost of registering a business in Uganda depends on several factors, such as the type of business, the location of the business e.t.c. Contact us for more information

Company Act of 2012 states that any one or two people may establish a company for lawful purposes by signing the memorandum of association or registering the business as required by the Companies Act.

The Registrar of Businesses in Uganda is the Registrar General of the Uganda Registration Services Bureau (URSB). The URSB is a government department in charge of business registration, intellectual property rights registration, and civil registrations. The Registrar General is the chief executive officer of URSB and is responsible for the overall management and administration of the Bureau’s functions, including the registration of businesses and other entities.

The easiest business to start in Uganda is determined by market need, available capital, and personal interests. However, some low-cost businesses that have potential include selling second-hand clothes, starting a small grocery store, offering cleaning services, or providing mobile money services. It is important to conduct market research and develop a business plan before starting any business.

Establishing a business in Uganda is more difficult stated than done, and while most Ugandans are eager to take the plunge, they are unaware of the requirements to make their business successful. The area of the law known as “business law” will instruct you on how to start and manage your business.

Sources of money to start a business in Uganda include personal savings, loans, grants, borrowing from friends and family, and crowdfunding. Entrepreneurs should carefully consider the terms and conditions of each option and choose the one that best suits their business idea and individual circumstances.